Mergers can be a great way to reduce rate liability if two or more contiguous properties are occupied by the same ratepayer.

The government’s 2023 rates revaluation came into force on 1st April 2023. In short, there is one clear winner emerging from this process, and that is retail.

Our May newsletter is out now with all of our latest news, click here to view. Subscribe to our newsletters or view our past issues.

When it comes to business rates, a landlord’s focus is often only on mitigating rates once a tenant vacates. However, Landlords should be taking a view across all business rates, including their current tenants, and here’s why

Business Rates is one of the biggest outgoings a business has to bear but it’s not easy budgeting for what has to be paid – Try our Business Rates Liability Calculator.

Our Winter newsletter is out now with all of our latest news and Winter Outlook, click here to view. Subscribe to our newsletters or view our past issues.

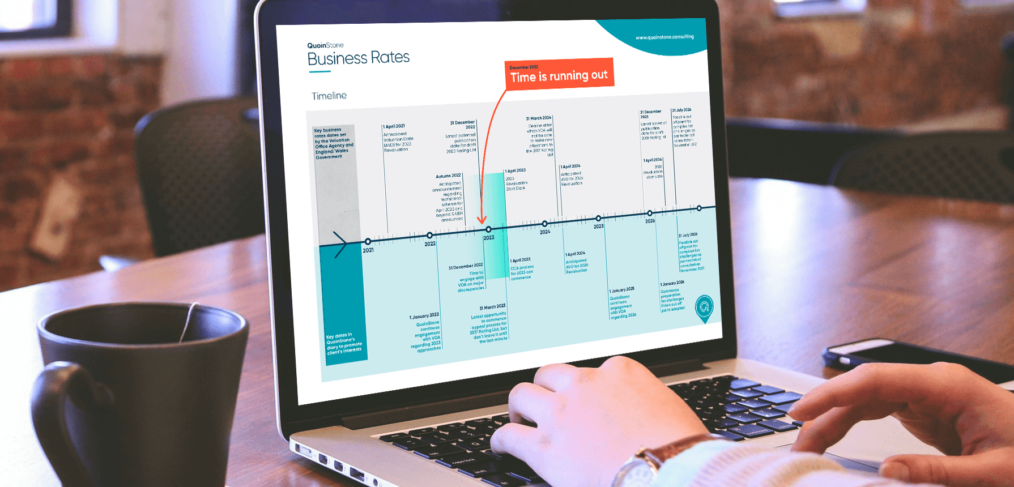

Download our timeline that represents all the key dates related to the upcoming 2023 rates revaluation. If you are a ratepayer (property owner or an occupier), the dates represent potential changes to your Business Rates liabilities and with it, new opportunities for reductions. It is important to keep on top of these dates and be proactive, because you may miss out on savings by leaving it too late. In particular by filing appeals on the current Rating List well before the 31st March 2023.

Under the current legislation, ratepayers can initiate an appeal against their business rates assessment on the current 2017 rating list up until 31st March 2023, which is the last day of the current list.

As we look to the new 2023 revaluation, 5 months away, we await publication of the draft rating list.

Our November newsletter is out now with all of our latest news and Autumn Outlook, click here to view. Subscribe to our newsletters or view our past issues.