Why it is more important than ever for landlords to focus on their tenant’s business rates liabilities as well as their own?

When it comes to business rates, a landlord’s focus is often only on mitigating rates once a tenant vacates. However, Landlords should be taking a view across all business rates, including their current tenants, and here’s why

The cost-of-living crisis is not only affecting individual households but is also having a considerable impact on businesses, leaving many finding it increasingly hard to survive. Tenants are being hit twofold by increasing utility bills and by rising service charges. They are looking for new ways to reduce their overheads in order to stay afloat. One liability that is often overlooked is business rates.

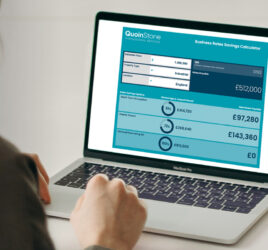

Considering overall increased financial pressure on tenants, Landlords should be taking a broader view in their approach to business rates. Tenants often go years unaware they are overpaying business rates, so the opportunity to make savings can be substantial. Landlords can assist tenants to find savings in business rates by instructing specialist rates surveyors to investigate rates liabilities and to find savings wherever possible. This helps the Landlord to retain tenants but will also mean that when vacancies do arise and the rates liability reverts to the Landlord, Landlords themselves will not be overpaying. Therefore, a shift in mentality from Landlords is important because in the longer term this will help to keep costs as low as possible for both Tenants and Landlords alike.

If you require business rates advice or would like us to undertake a full business rates audit of your portfolio, please get in touch here