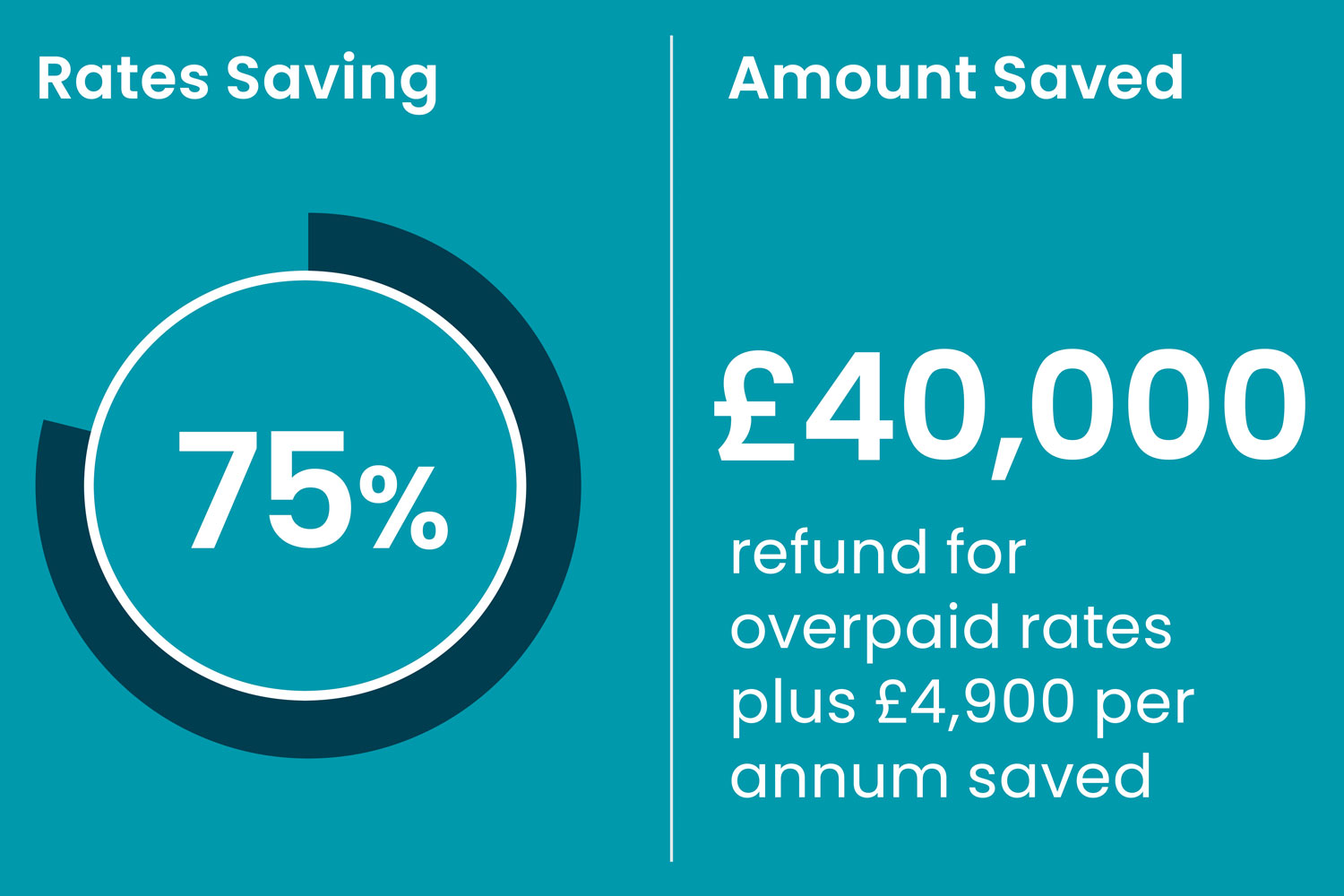

Our client had a single office suite under one legal entity. They had been in occupation of the office suite from 2014. The Rateable value came to £12,750. In most cases, to qualify for Small Business Rates Relief, the property must have a rateable value below £15,000 and the business must only use one property. We were able to contact the council on behalf of our client to apply the small business rates relief of 75%.

We were then able to obtain a refund on the rates they had been overpaying backdated to April 2017. After 6 years of overpaying, the refund came to approximately £40,000. Their rates payable changed from £6,500 to £1,600, saving them approximately £4,900 per annum.